Ultimate Guide to Financial Modeling: Strategies, Tips, and Techniques Explained

What is financial modeling? Briefly speaking, it is a combination of financial evaluations of past experiences, most likely assumptions and forecasts, that make your project worthy in the eyes of a potential investor. Financial models are the means that allow the stakeholders to make informed decisions based on your project’s potential.

While not all professional presentation design services specialize in the field of financial modeling, Whitepage’s experts do. So, today, we’ll try to lift the veil off the mysteries of financial modeling. Whether you are a financial expert or a business owner, this information will guide you toward effective and strategic financial projections that will enhance your startup’s value and future potential.

Care to make your presentation twice as informative and persuasive? This article is one of the puzzle pieces you’ve been looking for!

What is Financial Modeling?

Generally speaking, financial modeling is a precise reflection of your financial performance. There are a few main types of financial models to consider, yet each is used to calculate your current financial situation and stimulate a potential future scenario. The primary reason why financial modeling is so requested at the moment is because the approach is based on a company’s financial state that can predetermine various risks and outcomes that either attract or discourage potential investors.

When building financial models, it is critical to realize that every model serves a separate purpose, and you should pick the one that coincides with your business aim.

Three-statement model

Many financial modeling services use this model to merge a company’s income, balance, and cash flow into a single framework that can be used for a more in-depth financial evaluation.

Discounted Cash Flow(DCF) Model

DCF analysis is used to indicate whether the invested amount will grow in the future, making a chosen business a lucrative opportunity. Basically, the model implies that you determine the present value of your potential cash flow. The higher the value, the more likely a founder will pick you.

Merger Model(M&A)

This financial model example is used when there are two different companies at stake. A professional analysis of the financial background of both will give you an idea of how successful and profitable this merger will be. Simply put, this model indicates if a business or project in question is worth the effort.

Main use cases of financial modeling:

- Valuation – informed determinations of a company’s worth

- Forecasting –data-backed future predictions of a business’s financial performance

- Strategic planning – long-term business planning that includes potential expansions, launches, and other growth-related decisions.

The Components of a Financial Model

After covering the financial modeling basics, it is time to dive a little deeper into the structure of an expertly-made financial model. Three major parts make it whole and effective.

Input

A dedicated pitch deck design company specializing in financial modeling usually starts the project by attaining all available data. The gathered information makes a carcass of the model. The input contains such details as the following:

- Historical information – all the available financial statements, including, but not limited to, income, cash flow, and balance sheets, are revised to reflect existing trends and forecast projections.

- Assumptions – historical data gives room for experts to brood upon the potential future of the project. Usually, various industry insights and field benchmarks such as taxes, inflation, growth rate, and more are evaluated for a more established assumption.

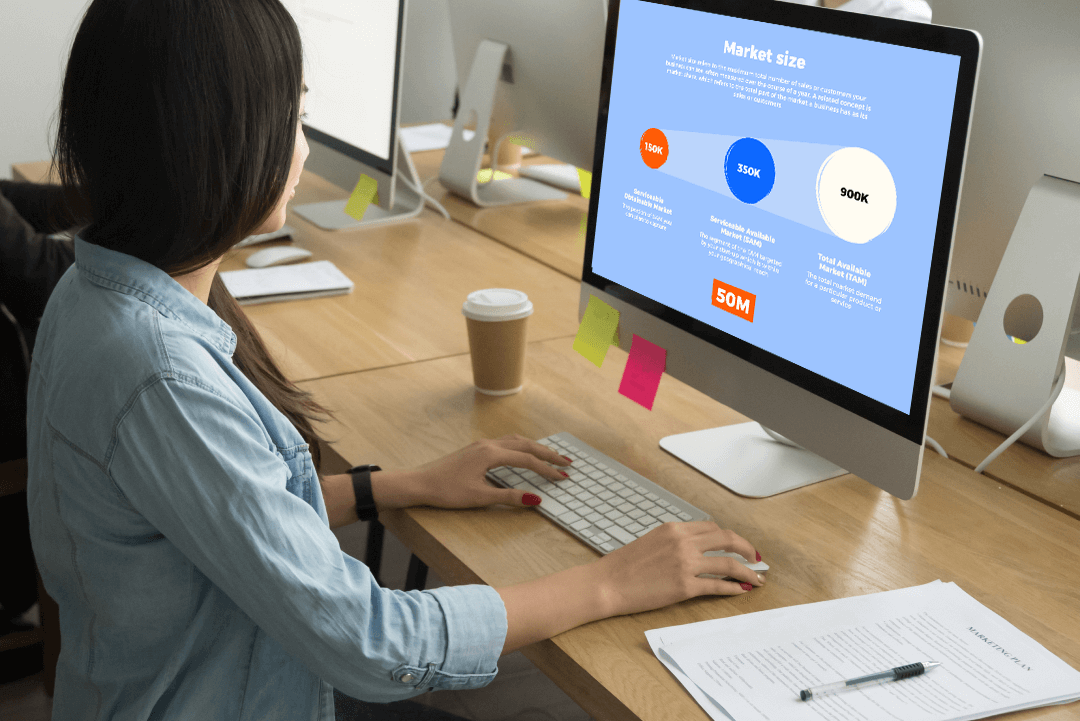

- Market analysis – to predict how your business will behave in the future, you must fully understand the market you are operating in. A reliable example of financial modeling would include market size stats, growth trends, competition, etc.

Process

After gathering the necessary information, you must convert it into palpable results or outputs. The conversion is often referred to as the Process stage. It is based on a few primary phases:

Linking

Based on the gained historical data and professional assumptions, financial experts create financial statements. All these statements are linked to one another so that any changes in one are reflected in all of them.

Scenarios

This is the phase when financial analysts play around with different numbers to see how they affect the assumptions and overall financial performance of a business in question. Depending on the request, the experts create various examples of financial models, such as best-case scenarios, worst-case scenarios, and base-case scenarios.

Calculations

When building a financial model like DCF, the financial team will deliver particular calculations that reflect the present value of future cash flows, etc.

Output

During the Output stage, projected financial statements, sensitivity analysis, and valuation metrics are delivered.

- Projected financial statement – is the reflection of a business’s financial health. Based on the most likely assumptions and scenarios, financial experts create potential income and cash flow statements along with the balance sheets.

- Valuation metrics – most Outputs consist of various field-specific metrics such as taxes, Net Present Value (NPV), Earnings Before Interest, Internal Rate of Return(IRR), and more.

- Sensitivity analysis – different financial models will react to assumption shifts in a specific way. A sensitivity analysis shows how susceptible a model is to the main variables.

How Does Financial Modeling Work? (Step-by-Step Guide)

It isn’t enough to define financial modeling. You must be fully aware of how it works to ensure that the results are accurate and relevant.

Gathering Data

Every success-programmed process starts with information collection, and financial modeling is no exception. You should acquire such details as:

- Available historical statements

- Operational data(sales volumes, number of employees, production cost, etc.)

- Market trends

- Primary financial assumptions

Setting Objectives

Now, with all the necessary details at hand, you must figure out the main goal you pursue. There are a few popular objections that a financial model can aim at:

- Strategic planning – whether you are planning to merge your business or expand, expert financial modeling examples will help you determine the overall financial impact of the act.

- Valuation – after some time in business, owners want to have a clear understanding of where they are standing, and a well-built financial model provides a valid estimation of the company’s progress and value.

- Forecasting – it is never a waste to have a glimpse into the future to decide whether the mission is worth the effort. Proper financial modeling relies on your previous performance data to predict the future.

- Budgeting – planning future expenses is yet another goal you can set while working on a proper financial model.

Creating the Structure

One of the many perks of adequate financial modeling is modification. If you create a logically structured and easy-to-follow model, you can re-use it if necessary. We have a few simple tips that will help you ensure that:

- Use different sheets for input, output, and calculations.

- Consider a modular type of financial models. A modular example ensures that while all the sections are interconnected, they can be modified separately.

- Label each element of the model clearly and understandably.

- Stick to the same type of formatting throughout the model.

- Use color coding to boost comprehension and readability.

Building the Model

All types of financial modeling are based on main formulas and functions that make them effective. We’ll review the primary ones to head you in the right direction:

Revenue forecasting is the starting point of every model. It consists of two methods:

- Growth rate – previous period revenue * (1+Growth rate)

- Market share – market size * market share

- Cost of goods sold (COGS)

- Percentage of sales – revenue * COGS %

- Unit cost – units sold * unit cost

- Operating expenses are calculated based on past statements

- Interest expenses — Average debt balance * interest rate

- Balance sheet

Cash – previous period cash + net income – dividends – change in working capital

Receivables – revenue * receivables turnover days/365

Payables – COGS * payables turnover days/365

- Cash flow

Operating cash flow – net income + depreciation – change in working capital

Investing cash flow – capital expenditures

Financing cash flow – debt issued – debt repaid + equity issued – dividends paid

Testing and Validation

.png)

After you learn how to build financial models, you may falsely assume that you are set to go. However, you must test and validate your assumptions to ensure that the model is accurate and reliable. There are a few things to check before you put your financial model to use:

- Check for errors, including but not limited to incorrect formulas, broken links, and other issues.

- Evaluate your assumptions. If you don’t think something is reasonable or logical in the pattern, it is based on double-checking the source of information as well as its reliability.

- Use stress tests to figure out how strong the model is. Trained experts can go as far as to apply the most extreme scenarios to determine potential weak spots.

Tips for Effective Financial Modeling

.png)

Even basic financial modeling will turn out to be twice as effective if you enhance it deliberately.

Simplicity is Key

The most practical tips usually lie on the surface. Surely, financial modeling is a complex science, but it is best to avoid overcomplicating things. Don’t try to fit every bit of available information in. Incredibly complicated models are not only hard to comprehend, but they are also more prone to being filled with errors. Focus on the essentials instead.

Accuracy of Data

Another quite obvious yet not less essential tip would be to use only accurate data. The more reliable the source of information – the better. Besides, it is never a waste to double-check, even if you build financial models on your own. Don’t forget that the assumptions you make should be more realistic rather than more appealing and promising.

Regular Updates

You don’t use static data when creating financial models. As the market conditions, financial details, assumptions, and other criteria change, you should reflect them in your model. That is why regular updates are a must. While keeping an eye on vital changes, some experts go as far as to generate more than a single model.

Presentation Tips

Financial modeling skills do not end with an accurate and well-structured example. You must present the model so that it triggers the desired response from the audience. At Whitepage, we have a few tricks up our sleeves when it comes to financial model delivery:

- Expert use of visual aids helps to break down complex notions in a simple, digestible, and engaging manner.

- Effective summarization of your critical findings and conclusions will guide the audience in the right direction. The better the audience understands critical points, the easier it will be for them to grasp the model fully.

- Practical customization ensures that you don’t bore experienced viewers with simplification and do not overwhelm inexperienced audiences with overly complex notions and terms. You should always tailor your financial model to your target audience.

- Consistent branding enhances the company’s expertise and reliability. That is why professional layout and formatting are an effective way to add an extra layer of credibility to your model.

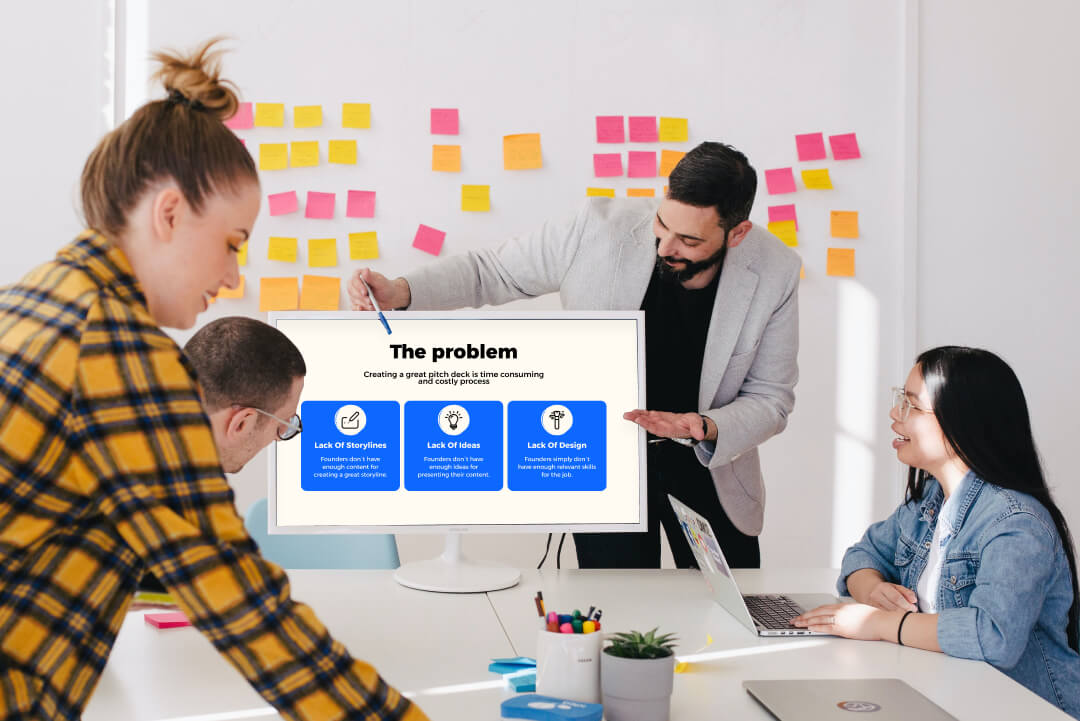

How Presentation Services Enhance Financial Modeling

Professional presentation services know how to do financial modeling to achieve desired outcomes. There are a few reasons why.

Visualization Tools

Seasoned presentation teams use visualization as one of the means of conveying complex information. For instance, they use various charts, tables, and graphs to deliver raw financial data into understandable trends. It helps the audience grasp vital insights, compare data points, and make informed decisions. The same goes for interactive dashboards that allow the viewers to sort different data by available filters and conduct a deeper analysis if needed.

Storytelling

Even a boring financial report can be presented as a compelling and well-structured narrative designed to engage and convert. Professional services usually organize the output logically so that the numbers tell a story. Moreover, trained experts know how to highlight the main points and interact with them so that scattered pieces of a puzzle become one. Let’s not forget that presentation experts can provide necessary contextual explanations without disrupting the model. Most stakeholders appreciate these explanations as they get to understand the offered assumptions better.

Customization

Finally, professional services know how to work with a business so that the model aligns with the company’s brand identity, views, goals, and ideas. They use custom design, audience-specific content, dynamic presentations, interactive elements, and other standards, which make a financial model more than an analytical asset but a powerful communication tool.

Conclusion

What is a financial model? It is an effective means of evaluating a company’s financial state, predicting palpable financial outcomes, and presenting strategic decisions. Professionally built financial assumptions can help you present your business in a more favorable light and decide whether to proceed with some table-changing shifts and merges.

At Whitepage, we not only know how to build a pitch deck that leaves a lasting impression but also how to create a financial model that will help you expand your business horizons. Contact our agents to find more information and scale your success!

Talk to a presentation design expert now!

Let's Talk

FAQ

Read more

.avif)

.webp)

.webp)